FLPP

FINANCING APPLICATION

FLPP is a house financing liquidity facility support for MBR participants managed by BP TAPERA.

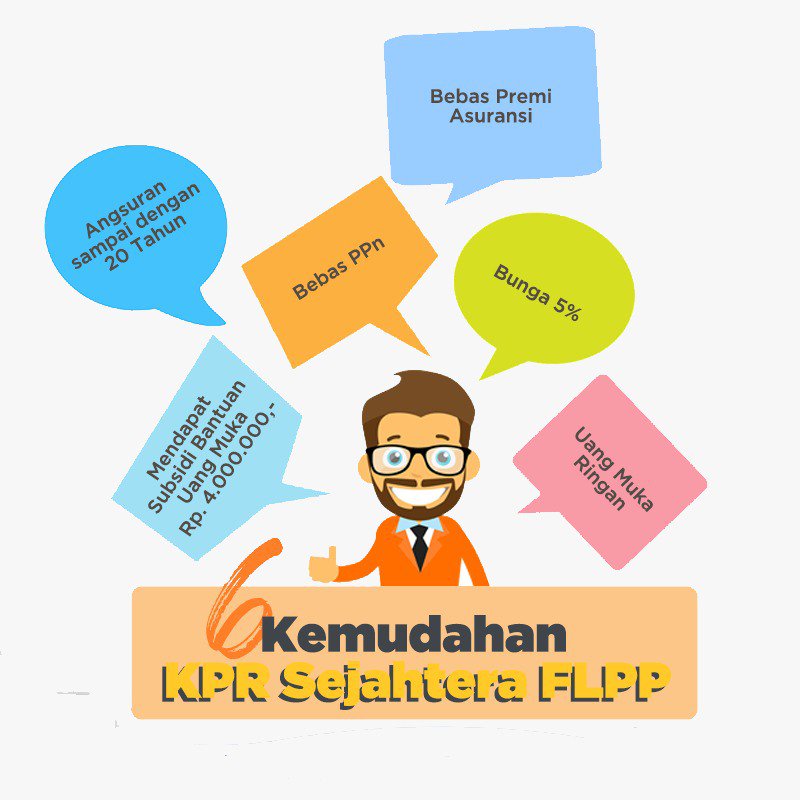

- 5% fixed interest rate during KPR period includes life insurance, fire and credit insurance premium.

- KPR instalment up to 20 years.

- Down payment starts from 1%.

- Free VAT.

- Indonesian Citizen

- Never get any subsidy nor house financing assistance by government in a form of KPR or credit/financing for self-supporting housing construction.

- Singles individuals or married couples.

- Do not have any house

- Having fixed or non-fixed income which equals or lesser than maximum income limit of IDR. 8 million per month, in accordance with the Minister of PUPR’s Decree No. 242/KPTS/M/2020.

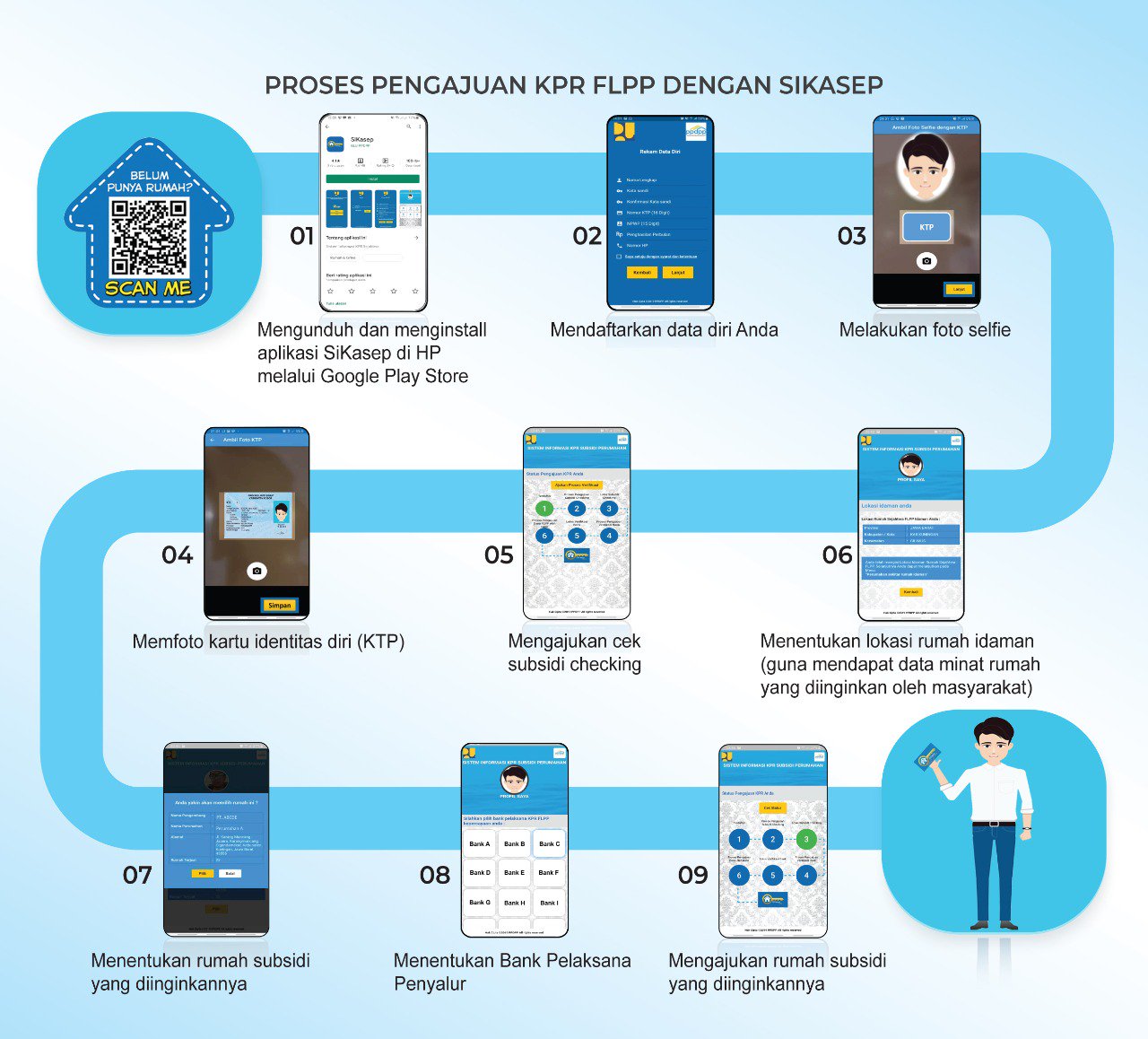

- Download SIKASEP Application via Google Play Store.

- Register on SISASEP application.

- Specify the house and Channelling Bank via IKASEP application.

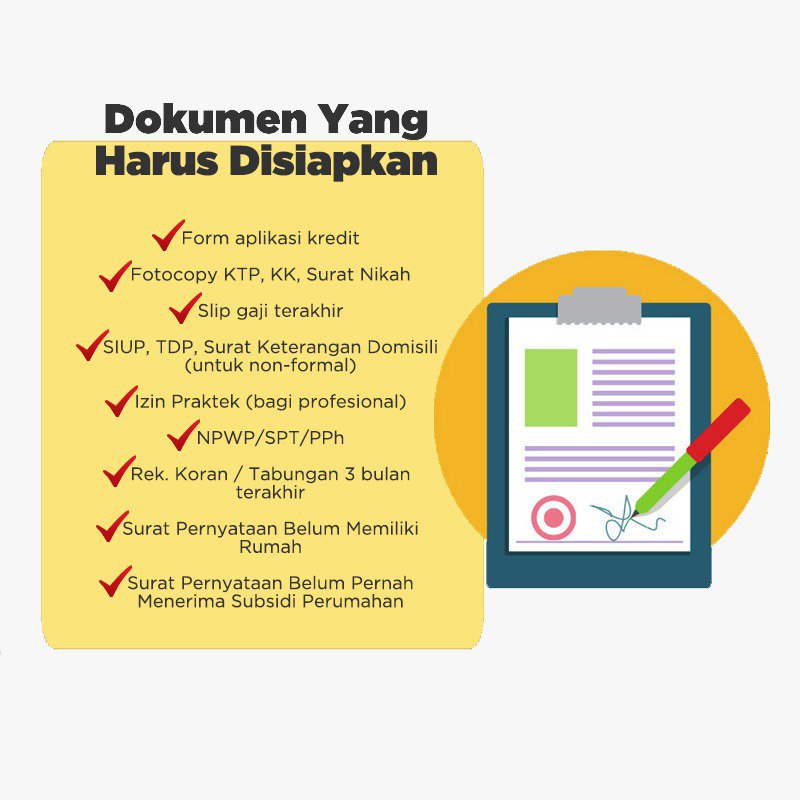

- Prepare the required FLPP KPR application documents by the Channelling Bank:

- House Order Form by developer which at least contains the house selling price and address.

- Copy of electronic Identity Card or ID card’s receipt.

- Copy of Family Card.

- Copy of marriage certificate for married couples.

- Copy of Tax Registration Number (NPWP)

- Copy of annual personal income tax’s notification letter.

- Applicant's statement.

- Salary slip legalized by authorized officer for applicants with fixed income, or income statement letter signed by the applicant and acknowledged by the Village Head/Lurah for those who do not have any fixed income.

Badan Pengelola Tabungan Perumahan Rakyat

Wisma Iskandarsyah Blok B2, B3, dan C3, Jln. Iskandarsyah Raya Kav. 12-14

Kebayoran Baru, Jakarta Selatan 12160.

Jl. Falatehan I No.27, RT.2/RW.1, Melawai, Kebayoran Baru, Jakarta Selatan, 12160

Copyright @ Tapera 2022